Fundraising

Develop your financing strategy relying on an agile and independent banking model.

A strategic and tailored financing approach

At Canovia Canada, we support entrepreneurs and executives

in developing and executing bespoke fundraising strategies,

whether for growth, innovation, acquisitions, or shareholder restructuring.

We operate as an independent partner,

to help you navigate today’s evolving financial landscape.

How Canovia Canada is doing fundraising ?

With a deep understanding of financial markets and investor expectations, we combine strategic thinking and operational execution to help you secure the right financing under the right terms. Whether through equity, quasi-equity, or debt instruments, we design solutions that align with your business goals and lifecycle.

Our Fundraising Services include

Equity & Quasi-equity Fundraising

Structure and execute capital raises with private investors, growth funds, family offices or institutional players.Debt Advisory

Design and secure optimal debt financing (senior, mezzanine, unitranche, convertible, etc.) adapted to your project and covenants.Hybrid Instruments

Explore flexible financing structures combining equity and debt to optimise your cost of capital.Financial Engineering & Structuring

Translate your strategic ambitions into robust financial terms and deal structures.Investor Readiness & Pitch Support

Build compelling investor documentation (teaser, business plan, financial model, equity story) to maximise engagement.

Our added value

- An entrepreneurial partner, not just a financial advisor : as entrepreneurs ourselves, we understand the stakes, timing, and pressures of strategic financing. Our support goes beyond pure execution: we challenge your assumptions, validate your roadmap, and connect you to the right partners — all while keeping your long-term vision in focus.

A powerful and independent network : thanks to our extensive network of financial institutions, funds, and private investors, and the strength of our 800+ professionals across the Group, we provide access to a wide range of financing solutions and sector-specific insights.

We can work alongside your existing advisors or bring in trusted partners to offer a 360° perspective tailored to your financing strategy.

Meet our Team

Meet the highly skilled experts who guide your M&A projects to success.

Baptiste Bloch

Financial Analyst

Claire Fillatre

Financial Analyst

Rayane Mohand

M&A Vice President

Marjolaine Luthy

M&A Lawyer

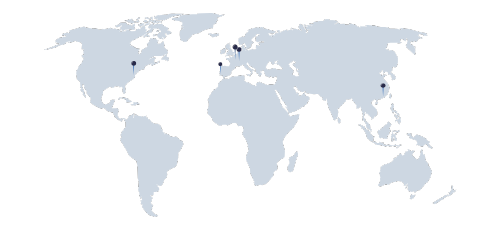

From Paris to Ottawa, through Hong-Kong

With 30 offices spanning Paris to Lyon, and a strong foothold in the heart of Burgundy vineyards.

From our office in Ottawa we connect North American investors and entrepreneurs with unique opportunities across Europe.

Ready to fund your next stage of growth?

Let’s build your financing roadmap together.

We help you structure, negotiate, and secure the capital that matches your ambitions.