Sharecropping

Strategic investment in European vineyards, combining asset preservation & long-term value

Investing in excellence, preserving the land

At Canovia, we open the doors to Europe’s finest vineyards

through carefully structured Wine Sharecropping (Groupements Fonciers Viticoles, in french).

These investment vehicles allow families, entrepreneurs and long-term investors

to acquire ownership in exceptional wine estates, while contributing to the

preservation of agricultural heritage and the promotion of responsible, sustainable viticulture.

Canovia’s exclusive approach to vineyard ownership,

A unique structure tailored for long-term investors and wine lovers.

Combining deep sector expertise and financial engineering,

our model enables investors to diversify their wealth with tangible, resilient, and culturally rich assets.

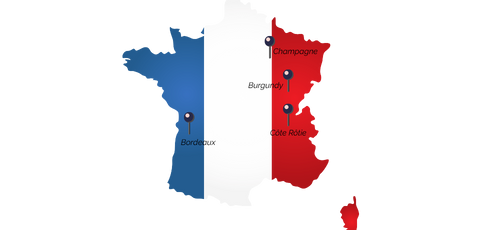

We carefully select vineyard operations across Europe, and especially most famous France estates,

working only with winemarkers committed to high-quality production and long-term ecological responsibility.

Our role is to structure and coordinate the operation end-to-end,

ensuring legal security, financial transparency, and lasting value, both for investors and for the land.

Our Sharecropping model includes

Selection of high-potential vineyards

Identification of properties based on terroir quality, wine reputation, operational robustness, and sustainability practices.Creation of dedicated land-holding companies (GFVs or equivalents)

Legal and financial structuring of the entity, defining investor rights, revenue models, and governance.Partnership with operating winemakers

Collaboration with skilled and committed winegrowers under long-term lease or sharecropping contracts.Opening to international investors

Turnkey access to an exclusive asset class, with full support for non-resident investors.Ongoing management and reporting

Stewardship of the investment over time, ensuring regulatory compliance, asset maintenance, and transparent communication.

A unique blend of tradition and strategy

Unlike classic real estate or financial products,

sharecropping investments offer a blend of tangible heritage, emotional connection, and real economic value.

They contribute to preserving the land, promoting local employment, and ensuring the sustainability of exceptional vineyards,

while offering stable returns and capital appreciation over the long term.

A responsible investment with legacy potential

Whether you are building a family portfolio, planning transgenerational wealth,

or looking for a meaningful ESG-aligned investment, our wine land holding structures provide a rare opportunity

to combine financial performance with cultural and environmental impact.

Our team works with your advisors (or provides in-house support through our 800+ Group professionals)

to tailor the structure to your investment goals and personal values.

A dedicated team of experts

Most prestigious European vineyards

Meet the team

Meet the passionate expert bringing our sustainable vision of viticultural sharecropping to life with their deep expertise.

Nicolas Guérin

Managing Director, Partner

Mathilde Filippi

Communication & Event Officer

Elodie Sanloup

Rural Lawyer

Anna Tocheva

Corporate Lawyer

Interested in owning a piece of Europe’s finest terroirs?

Let’s build a meaningful and resilient investment — rooted in nature, culture, and long-term vision.